Health and Wellbeing

Taxation & Financial Planning

Taxation & Financial Planning

We are an integrated financial services provider offering various opportunities to investors for wealth creation, capital appreciation and market analytics.

Our vision is to empower clients with our holistic approach and financial wisdom. Thus, we nurture their investments into appropriate channels to reduce risk and maximize returns. The combination of a broad as well as focused outlook enables us to provide value investments to our clients.

Active interaction with the company officials, in-depth sectoral analysis and macroeconomic understanding help us understand the fundamentals of a company, the surrounding dynamic environment and also predict its future potential.

The Union Budget for 2022-23 was presented on 01st February 2022 by the Finance Minister Ms. Nirmala Sitharaman in the backdrop of Gross Domestic Product (GDP) growth rate of 9.2 percent for the year, strong exports, robust increase in both direct and indirect revenues, robust vaccination programme, a tapering Omicron wave, favorable response to the Production Linked Incentive (PLI) schemes announced in the last few years, a vibrant start-up ecosystem with the third-highest number of unicorns in the world after the US and China and strong revenue collections.

The Union Budget 2021-22 was presented by the Hon’ble Finance Minister Nirmala Sitharaman on 1st February 2021 in the Parliament, which was the first budget of this new decade and also a digital one in the backdrop of unprecedented Covid – 19 crisis. This year’s Budget lays focus on the six pillars for reviving the economy –

-

-

Physical and Financial Capital and Infrastructure

-

Inclusive Development for Aspirational India

-

Reinvigorating Human Capital

-

Innovation and R&D

-

Minimum Government Maximum Governance

Honourable Shri Narendra Modi launched the START-UP INDIA – ACTION PLAN, the same will help nurture entrepreneurship in the country. The START-UP INDIA – ACTION PLAN defines What is Start-up, Eligibility for Startup, Recognition as a Startup. The Action Plan gives a road map for faster Entry & Exist along with Financial & Taxation Benefits available to the startups.

Legal Provisions are likely to be incorporated in Finance Bill 2016, thereafter proposed scheme of START-UP INDIA will get a legal shape.

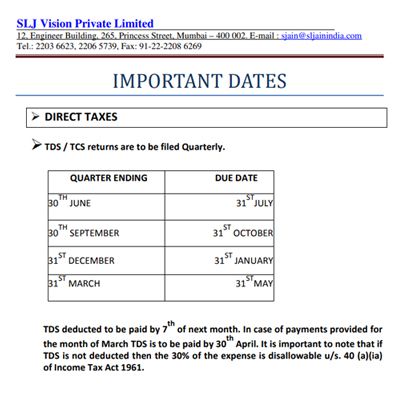

Your date with legal compliances.